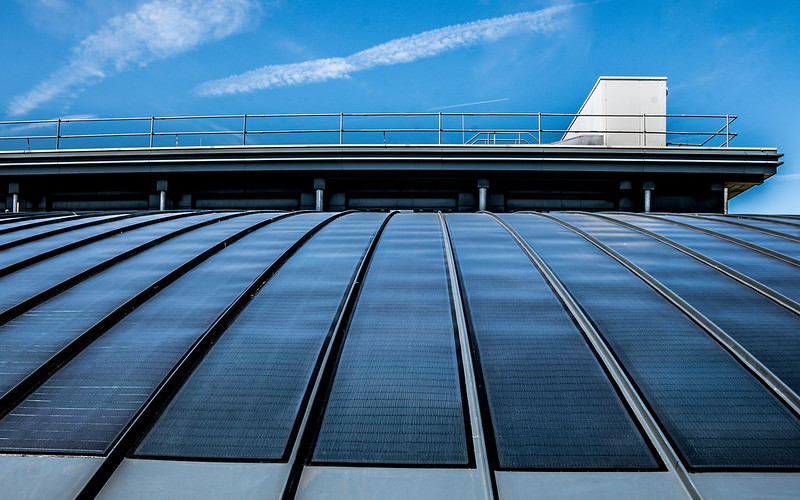

In a new paper, Dr Guangling Zhao and colleagues undertook an economic analysis of the Active Office’s building-integrated photovoltaics (BIPV) and energy storage.

It showed that the Active Office’s BIPV will pay back within its lifetime but the Lithium-ion batteries will not (based on the operation and tariff structures at the time).

This type of analysis requires time, and the world of energy is changing rapidly. There have been big rises in energy costs since it was done. While the research represents a snapshot in time, the operational strategies and research methodology remain relevant and can be adapted.

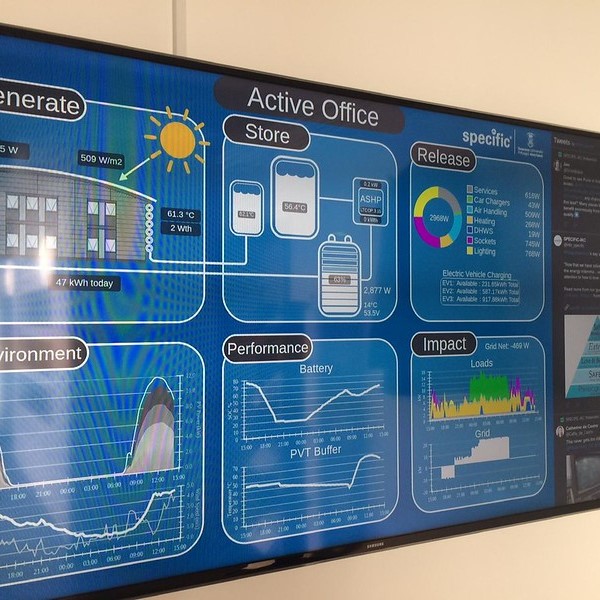

The Active Office was built in 2018. It uses a combination of BIPV and Lithium-ion (Li-ion) batteries (among other technologies) to generate, store, and release its own energy. The batteries are used to store energy from the BIPV or from the grid, depending on the operational strategy.

During this research, the building’s operation was optimised using a variety of different strategies to: maximise use of renewable energy and reduce carbon emissions; to minimise energy costs by time-shifting demand to periods of lower cost; or to minimise impact on the grid.

Could the BIPV and Li-ion batteries in the Active Office pay back within their lifetime?

Researchers wanted to know whether the BIPV and Li-ion batteries in the Active Office would pay for themselves during their lifetime, under the different operational strategies.

They looked at the costs of both technologies, taking into account:

- The capital cost of 22kWp of BIPV

- The capital cost of 110kWh of Li-ion batteries

- Electricity costs from the grid

- The potential carbon cost of electricity both from the grid and generated by the Active Office

In the energy market at the time, the research found that BIPV units on their own would pay for themselves within 7 years. On the other hand, while the batteries improved self-consumption and reduced costs in the summer, it was not enough to compensate for their capital costs.

Factors affecting battery payback period

The cost-effectiveness of batteries depends on four main factors (in addition to the initial capital cost):

- Having enough control in the building to manage energy supply and demand

- Choice of operational strategy

- Having an energy tariff that supports your chosen operational strategy

- Round trip efficiency of the battery – or the amount of energy that is lost between charge and discharge

While technology and operational choices are largely within the building-owners control, the tariff is supplied by the market.

On a domestic tariff, batteries could be worth the investment

The Active Office is on a commercial tariff, which is a lot cheaper than domestic tariffs are at the moment. There is also greater innovation in domestic tariff structures. In a domestic setting, batteries might therefore be worth the investment.

We have examined some data from a domestic setting during a project with Tan y Lan Fach holiday cottages. There, we were able to recommend installation of batteries because modelling suggested they would benefit the owner’s aims. We therefore provided him with a structure with which he could examine cost-effectiveness based on his own usage and tariff.

To be continued…

Even though this economic analysis shows that installing BIPV and battery in the Active Office is not convincing at its capital price, the combination of technologies does enable the Active Building to be independent of the grid, to balance electricity demand and its own generation, and to improve its energy resilience.

These innovative technologies may not yet be perfected, but part of our mission is to test and optimise them in a real-life context.